florida inheritance tax amount

Food prescription drugs and non-prescription drugs are exempt from taxation and amusement machine receipts are taxed at only 4. A federal change eliminated Floridas estate tax after.

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Florida charges a state sales tax of 6.

. The federal estate tax exemption for 2021 is 117 million. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023 and the estate. Web For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

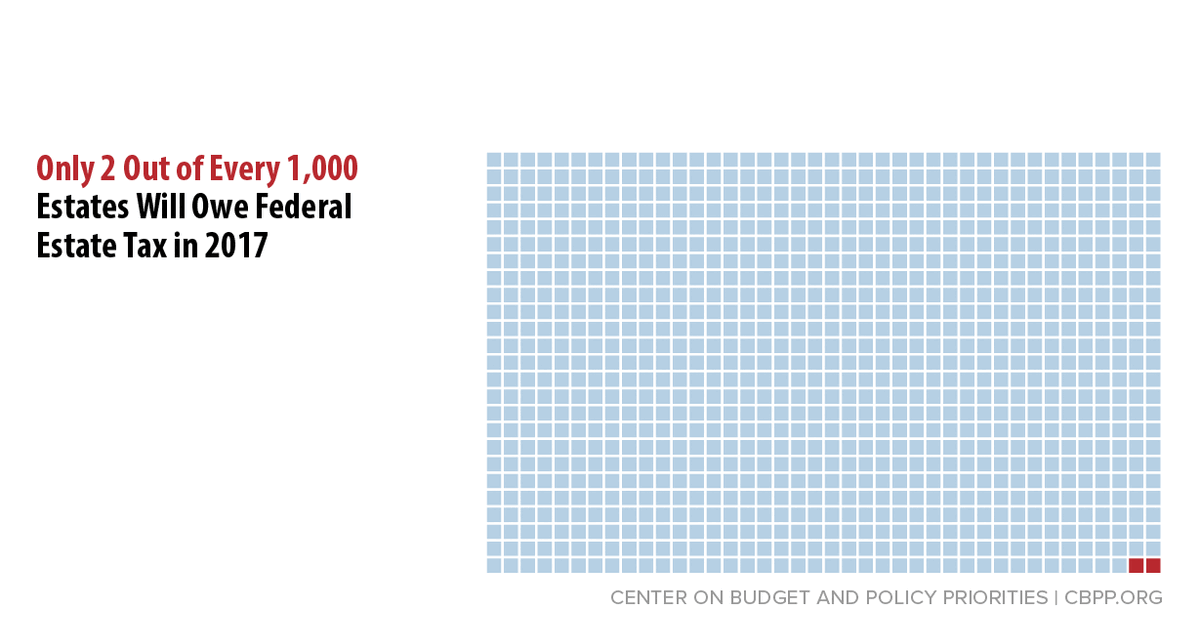

Additionally there is a federal estate tax however this will only affect very high-asset estates. Web Even though Florida doesnt have an estate tax you might still owe the. The estate tax exemption is.

Ad Search For Info About Does florida have an inheritance tax. Ad Better than all forms and kits. Web The final individual state and federal income tax return must be filed by.

DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Web Just because Florida lacks an estate or inheritance tax doesnt mean that. Web The rate for these types of contracts is 35 cents per 100 of value.

Browse Get Results Instantly. How much can you inherit without paying taxes in 2021. Web The inheritance tax rate depends on the state and ranges from as low as.

However a federal estate tax applies to estates larger than 117 million. Web There is no federal inheritance tax but there is a federal estate tax. Web However if you are inheriting a sizable estate you must consider federal inheritance tax.

Web The federal estate tax exemption for 2021 is 117 million. Web Florida Estate Tax. And thats a good thing too because the federal estate tax rate begins at a shocking 40.

Web As of January 1 2017 the federal estate tax applies to all estates worth. Web Florida residents are fortunate in that Florida does not impose an estate. Counties are permitted to add additional fees.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Web If you have assets in other states which do this may complicate your estate planning matters. Web To the extent its assets exceed the 1118 million exemption as of 2018.

Web There is no federal inheritance taxthat is a tax on the sum of assets an individual receives from a deceased person.

Florida Inheritance Laws What You Should Know Smartasset

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

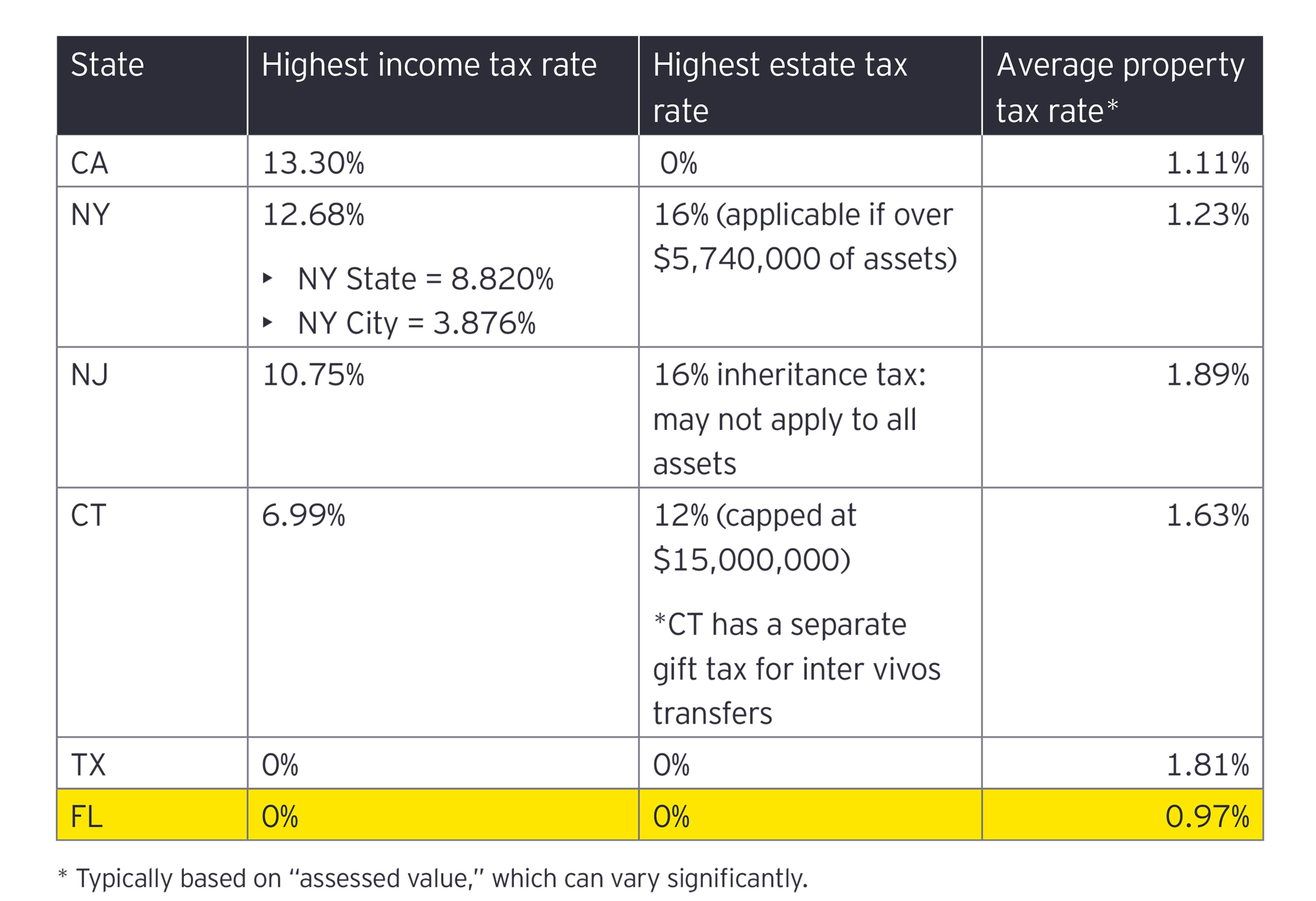

Tax Considerations When Moving To Florida Ey Us

Florida Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/Florida-47fa1160b4c84aec92f9de766d9163ff.jpg)

An Overview Of Taxes And Tax Rates In Florida

Florida Tax Laws Gulf Coast International Properties Naples Real Estate Team

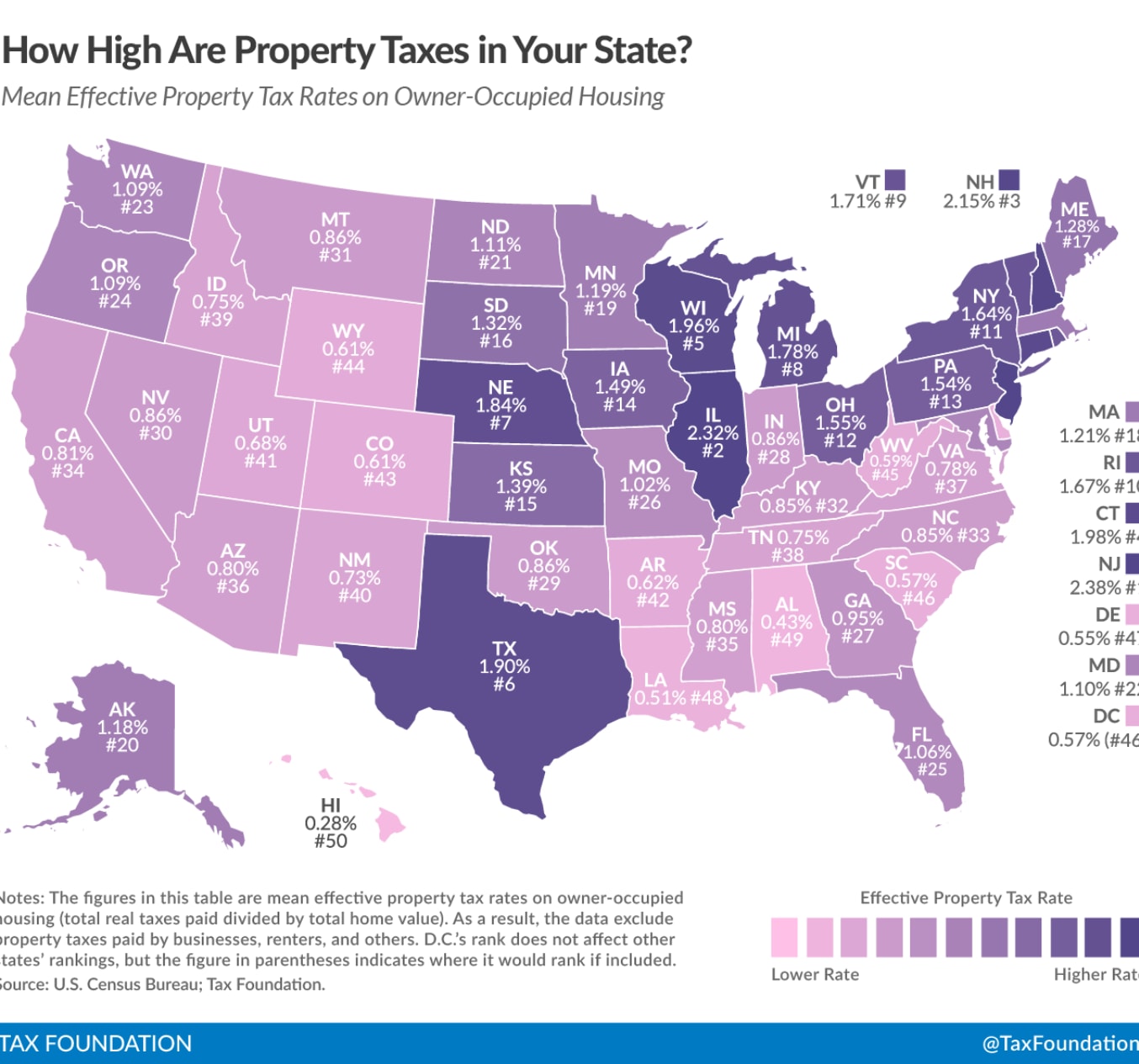

Estate And Inheritance Taxes Around The World Tax Foundation

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Florida Inheritance Tax And Estate Tax Explained Alper Law

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Illinois Should Repeal The Death Tax

What Is The Death Tax And How Does It Work Smartasset

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

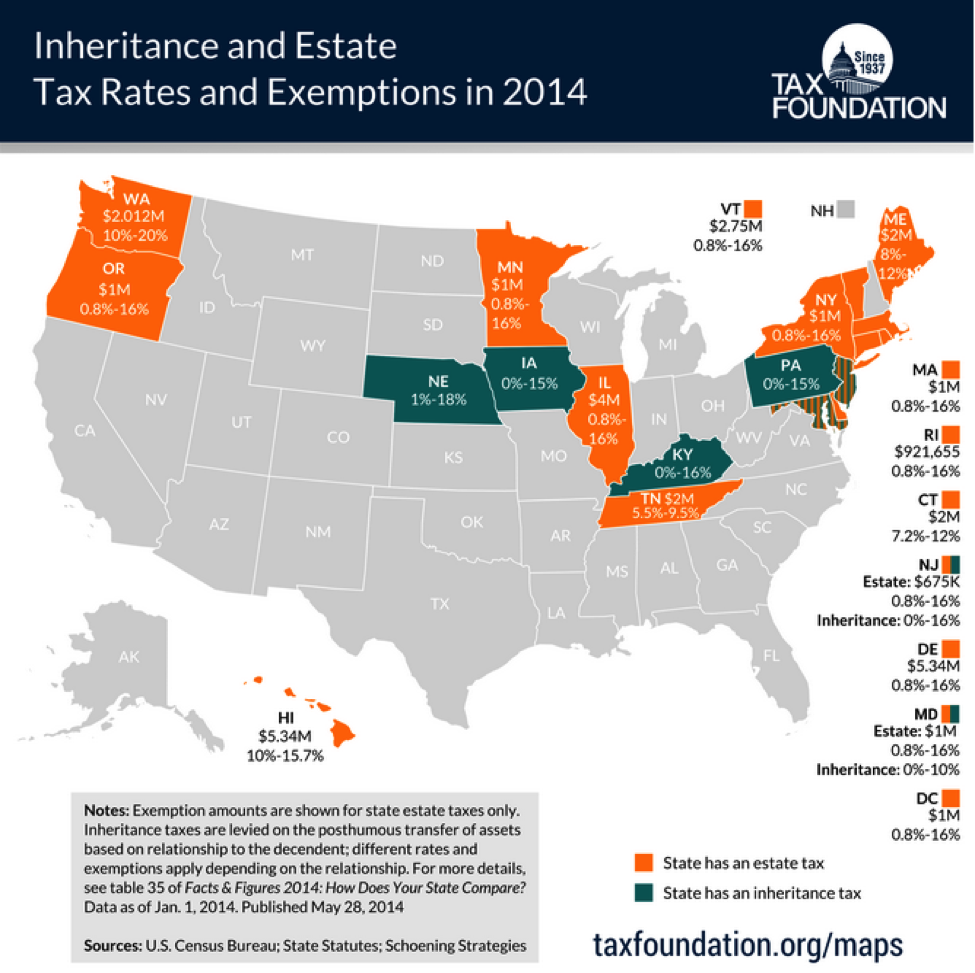

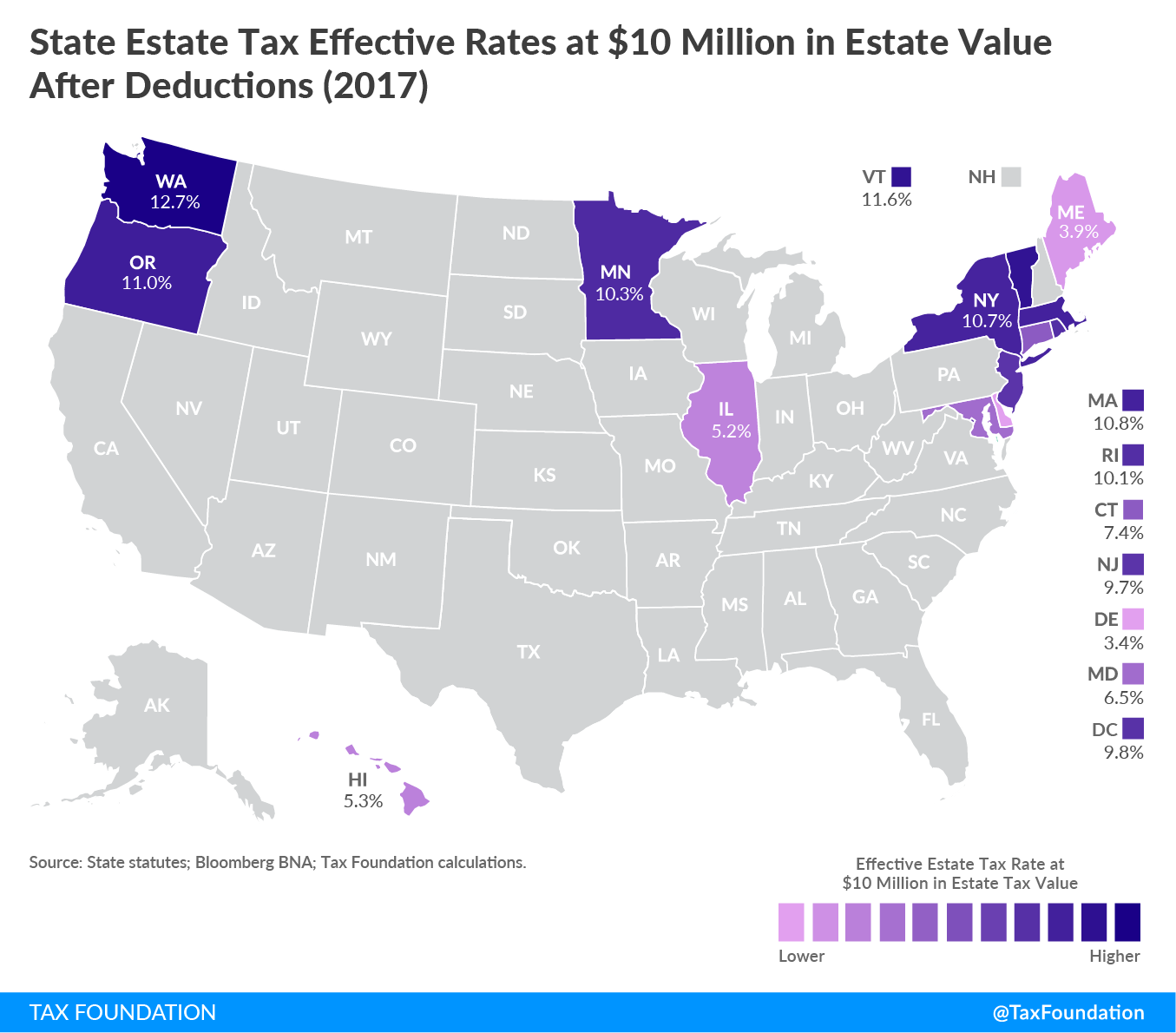

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

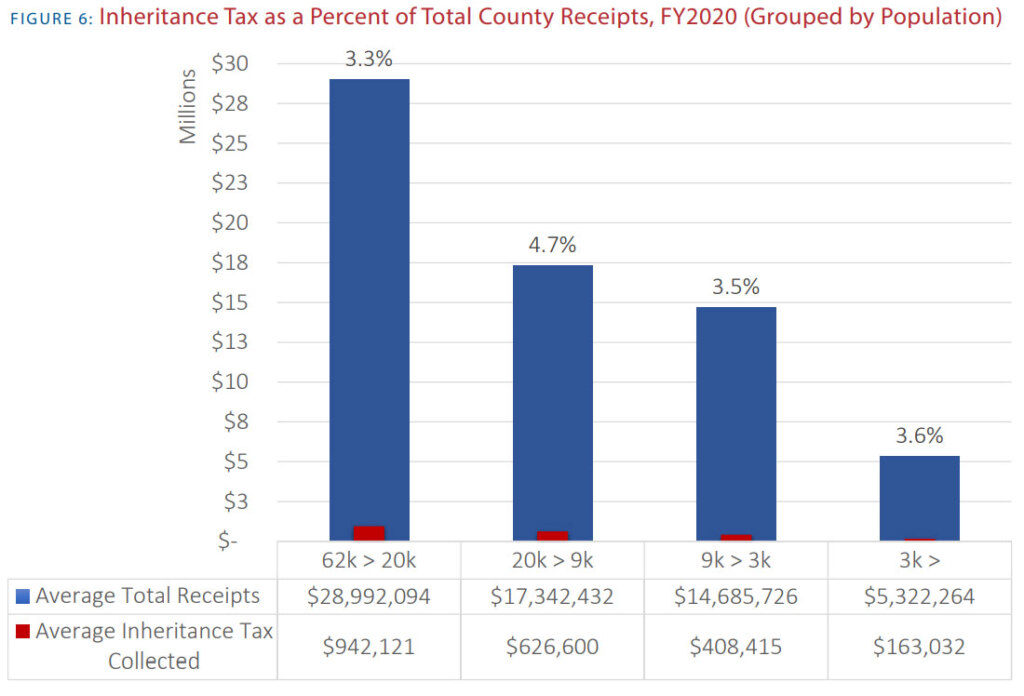

Death And Taxes Nebraska S Inheritance Tax

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com